Blog Disclaimer 'Message As Received

-------

MESSAGE

Latest Investment Opportunity

About The Company:

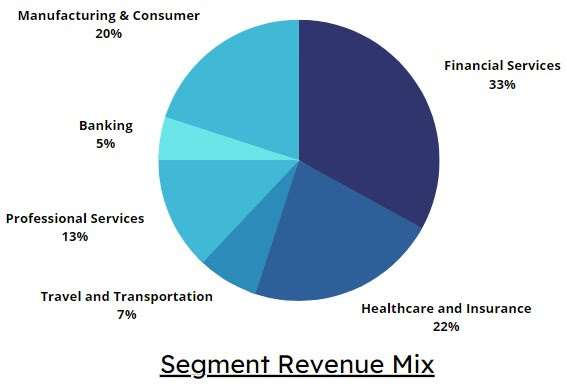

- Hexaware Technologies Limited is a leading global provider of IT and BPO services.

The company provides services to clients in Banking Financial Services,

Capital Markets, Healthcare, Insurance, Manufacturing, Retail,

Education, Telecom Professional services (Tax Audit Accounting and

Legal), Travel Transportation and Logistics verticals.

- The Company had added 4 Clients in the $20 - $35 million category and 8 clients in $10 - $20 million category

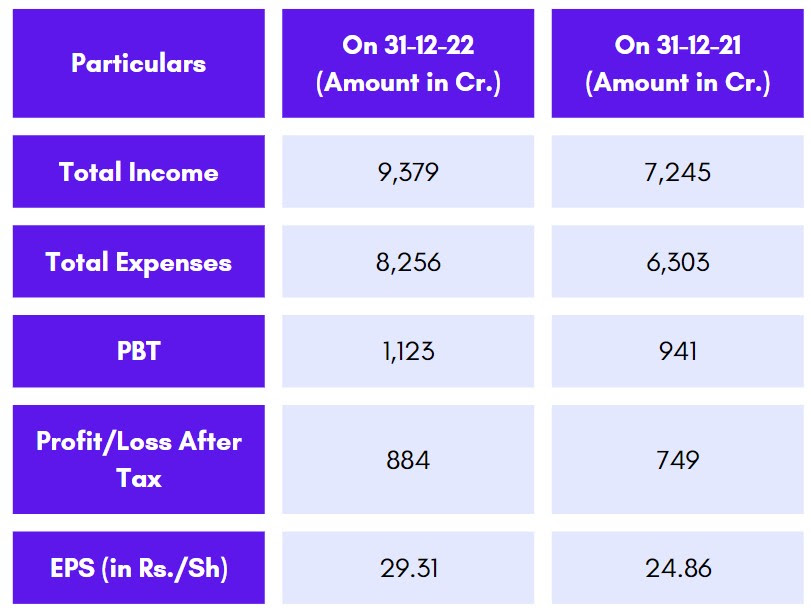

- In 2022, growth in revenue was 28.2% in ₹ terms as compared to 2021.

- Adjusted EBITDA before RSU cost increased by 7.5% in ₹ terms as compared to 2021.

- EBIT growth in 2022 was 16.3% in ₹ terms as compared to 2021

Excellent Dividend Payer:

FY2024

- 13-Apr-23: Rs. 9/share

- Next part of the dividend is expected in october

FY2023

- 14-Oct-22: Rs. 8/share

- 07-Apr-22: Rs. 14/share

Product Portfolio:

Hexaware is leading their clients’ digital transformation

experience to the next-level by leveraging industry-leading delivery and

execution model, built around a three-pronged strategy:

- Tensai: It Is an end-to-end automation platform built using open-source components.

- Amaze: It is a suite of offerings supporting all the major stages of the cloud transformation process.

- Mobiquity: It combines the best of human-focused design and data-driven technology

Milestones:

Year 1995:

- Started operations in North America & Europe

Year 2006:

- Successfully completed the acquisition of US-based Focusframe Inc,

specializing in automated testing of ERP, in an all cash deal of $34 mn.

Year 2008:

- It was ranked 15th in the NASSCOM Top 20 IT Software exporters from India

Year 2010:

- Expanded reach to 20 Countries

- Established Global Delivery Center in Bengaluru, India

- Signed 1st $100 Mn+ contract

Year 2015:

- Launched Manufacturing & Consumer Vertical

Year 2017:

- Reoriented business strategies around 3 cornerstones

Year 2020:

- Competition Commission of India (CCI) approved global private

equity firm Carlyle Group’s bid to acquire Baring Private Equity Asia's

(BPEA) Indian portfolio Hexaware Technologies at a $3 Billion Valuation

|

|

|---|

|

| |

|

|

|

|

|

|

|

|

| |

Performance in Pre-IPO Space:

We had first invested in Hexaware Pre-IPO Shares at around Rs. 470/share on Nov’2020 and since then here is how the price graph has moved of Hexaware Pre-IPO Shares:

Jan 2021 – Rs. 525/share

Oct 2021 – Rs. 899/share

Aug 2022 – Rs. 535/share

Sep 2023 -- Rs. 625/share

This translate to a CAGR of roughly around 33%+

Financial Highlights:

|

|

|

| |

|

|

|

|

|

|

|

| |

|

Growth

From the last 3 years, Hexaware's topline has increased by an average 15% and bottomline has increased by an average 20%.

Great Dividend Yield:

Hexaware has given dividend yield of 5% in the previous years and we can expect the same in future.

Carlyle's Acquisition:

- Carlyle Group, a US-based PE firm, bought Baring Private Equity Asia stake in the IT firm for reportedly close to $3 billion.

- Private equity offers clear added value to a company. These are experts who constantly analyze businesses.

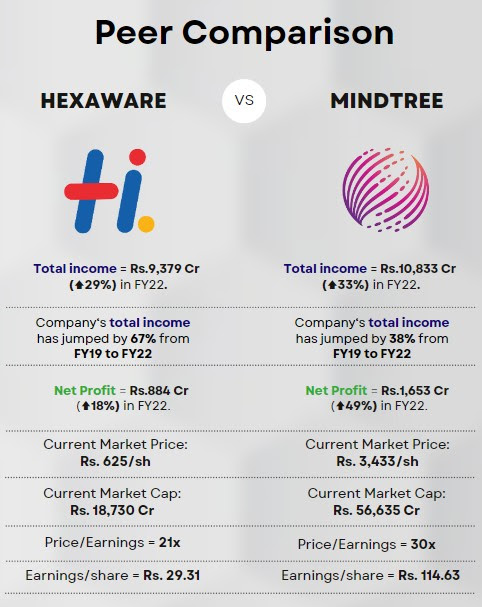

- At the moment hexaware is available at valuation of $2.2 billion (approx Rs.625/sh) in the unlisted space.

Business:

- Sustainable Strong Growth - Robust financial fundamentals acting as a pillar of growth.

- Client Base - A base of 320+ active clients with close to 92.4% revenue derived from repeat business.

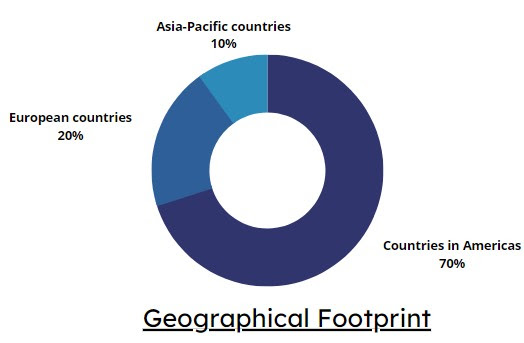

- Geographical Footprint - Presence across 27 countries in 4 continents.

- Diverse Product Offering - Strong domain expertise to provide best-in-class offerings.

- Team of Skilled professionals

- The team comprises people from different regions of the world with

diverse skillsets that give strong impetus for growth with a headcounts

of 24,000.

IPO Plans:

Hexaware is planning to go for an IPO in the next 12 months, either in the Indian market or NASDAQ

|

|

|

| |

|

|

|

|

| |

Use the code "HEXA500" on the minimum purchase of Rs.1 Lakh and get an instant discount of Rs.500!!

Click Here to watch the in depth analysis of hexaware technologies.

| | | | |

Blog Comments

Blog Caution

Two Way Quotes ( i.e simultaneous Buying / Selling Rates ) given by Dealers may be Incorrect.

Investors, please, Recheck from Independent

Please , also , read

http://www.rareindianshares.info/2017/09/dealers-two-way-quotes-can-be.html

Dealers of Unlisted / Delisted Shares

Please click the link For Many Dealers' Contact List

http://www.rareindianshares.info/2021/05/dhruval-shah-selling-metropolitan-stock.html

Dealers of Rare Indian Shares

Sambhav Aggarwal

Arms Securities

Tel : +919899131155

MANISH

9958006642

3A CAPITAL SERVICES

NILESH KOTAK

08866004076 - Whatsapp also

InvestorZone ,232/12, New Kot Gaon, Ghaziabad, ,Dinesh Gupta, Partner

DHARAWAT

08108303330 or dharawat1@gmail.com

SANDIP GINODIA

9830271248

OPPOSITE HIND CINEMA, NEAR AXIS BANK

73a, GANESH CH AVENUE, 2ND FLOOR, KOLKATA-700013

Vipul Gandhi

Gandhi Associates

25, New Jagnath, Saptabhumi Apt., (GF)

Rajkot-360001

Phone : + 91 - 281 324 6757 / 329 6757

.

Dilip Surana

Strides Financial Services

"Arihant Plaza"

84-85,Wall Tax Road, Ist floor

Park Town, Above SBI

CHENNAI 600003

Phone No 044-25350312, 25350313

Fax No 044-42371148

Mobile 9840278351 95000 95121

dilipmsurana@gmail.com

IP Gupta M.Sc,MBA,( Faridabad ) ,also consultants for problematic transfer cases - m- 9971104447

Important Blog Request

Because of technical reasons we are unable to our full list of Dealers.

Please do click on this link for our full list

Complete List of Dealers

.Please Must CLICK the link For Many Dealers' Contact List

http://www.rareindianshares.info/2021/05/dhruval-shah-selling-metropolitan-stock.html

4 Additions To The Previous List

1. Tarun Jain ,+91-9716719433 ,+91-9968510065

tarun90.jain@gmail.com

2. www.altinven.com

3 https://blog.unlistedkart.com/

4 Dee Unlisted Store (One Stop Shop For All Your Unlisted Shares Trades)

Deepa Bhatia (+91 9820900224)

Haresh Bhatia (+91 9423080060

No comments:

Post a Comment